To see the chat, try to refresh in about 5-10 minutes.

The release of Bitcoin futures contracts has helped to spur further interest.

Want to share your opinion on this article?

Cryptocurrencies are gaining a lot of attention in the market right now, but investors are still having trouble gaining exposure.

Furthermore, the company makes it a point to secure its own Bitcoin via Xapo as its custodian. This is a company with actual deep cold storage vaults that the company uses to store its investment. The protections include private keys, cryptographic security, and even physical security.

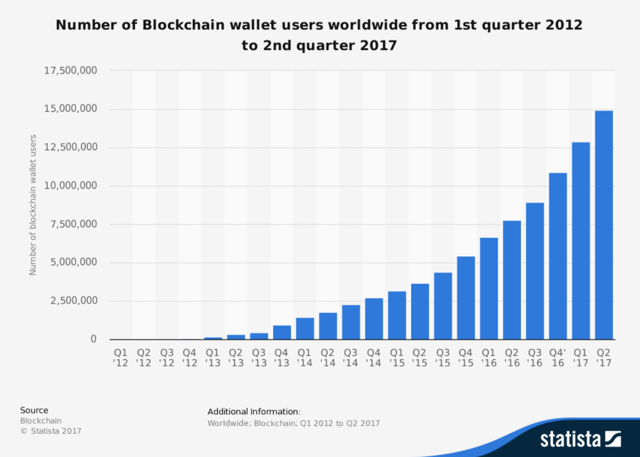

Cryptocurrencies like Bitcoin, Ethereum, and Litecoin are captivating investors and even non-investors the world over right now. New cryptocurrency wallet accounts have seen a significant increase over the last 3 years. But even with this being the case, one of the biggest barriers to entry has been themethod to get set upin order to buy cryptocurrencies.

With the launch of possibly 3 new futures contracts from CME Group (CME), Cboe Global Markets (CBOE), and Nasdaq (NDAQ), the market could continue to see the interest grow. Without oversight from organizations like the SEC, the world for cryptocurrencies may continue to see high levels of volatility. Therefore, if high-pace is a good thing then stocks in this sector could be your cup of tea.

We apologize for the inconvenience.

Furthermore, we may see more attention on the adoption of cryptocurrencies as a form of payment than something to simply invest in. Square (SQ) and Overstock (OSTK) have both made strides to involve Bitcoin in their operations. Overstock now accepts the digital currency for payments and Square is testing out an option to allow its users to purchase Bitcoin directly through its Cash App platform.

Similar to MGT Capital and Riot, the expansion into digital currency mining presents great opportunity for Marathon, especially with the price of Bitcoin continuing to rally. But unlike other Bitcoin stocks, Marathon could also have a much better hedge against a potential bubble burst.

Back in November, the company announced that it would distribute a portion of the rights to Bitcoin Gold tokens to Record Date Shareholders on December 4, following the Bitcoin fork. This equated to the rights to about 0.09217291 tokens of Bitcoin Gold per share. Bitcoin Gold was roughly $286 per coin on December 4.

After restructuring the company, completing a reverse split, and becoming compliant with Nasdaq again, Marathon Patent Group has come back on the scene with a big focus on the emerging digital currency industry. The company acquired a digital asset technology company, Global Bit Ventures Inc. in November. Global Bit specifically mines cryptocurrencies.

Please upgrade your browser or use a different browser, such as Google Chrome.

Unlike MGT, however, its investment into mining rigs also includes those that will be able to mine Litecoin. The reason I mention this is that ever since Bitcoin futures launched, many pure crypto-investors have focused on alt-coins like Ether and Litecoin for more volatility. Over the last week alone, prices for Litecoin have increased from under $100 to nearly $400. Litecoin mining could prove to be a welcome addition to Riots opportunity with digital currency mining, especially considering that compared to Bitcoin prices, a small rise of $100, for example, would be a much larger percentage gain. With Bitcoin prices increasing and mining operations in motion, the stockpile of new cryptocurrencies for Riot could easily build stronger shareholder value and directly impact the revenues of the company.

A10 Networks (ATEN) founder and CEO Lee Chen explained, I think the digital transformation is the underlying motivation for hackers … So expect the frequency, the size, the volume of hacks to continue to increase in 2018.

The Washington-based company is building out a mining operation and has a goal of hitting at least 5,000 Bitcoin mining rigs by the first quarter of the New Year. A quick search revealed that a single Bitman S9 (the specific mining rig being used) costs between $3,500 and $5,000 retail.

The chat platform is currently undergoing maintenance.

The company has stated that it expects to see $4.0 million in monthly revenue. But at the time of the initialannouncement, Bitcoin prices were between $12,000 and $13,000 per Bitcoin. Today, prices are well above $15,000 per Bitcoin. Some speculate that the price of Bitcoin could be north of $100,000 according to some of the market commentators who called the first Bitcoin boom, I wouldnt be surprised to see a six figure headline, said Dave Chapman, Managing Director of cryptocurrency trading firm Octagon Strategy, in aninterviewon CNBC.

The growing interest from investors at both institutional and retail levels has made Bitcoin and other cryptocurrencies one of 2017s active trades. The cryptocurrencys price has increased by more than 1,000 percent this year alone. Global exchanges like the CBOE, which just recently launched futures contracts, and the CME, which will go live next week, are just a few examples of the rampant growth and interest that this market has spurred.

Palo Alto Networks (PANW), for example, has already begun to see the threats evolve and it isnt where you may think. Generally, hackers look to score Bitcoin from wallet sites but in this case, it has found that there were hundreds of websites running Coin-Hive.

Though the script isnt necessarily malicious, it has been the use of the script, which poses potential danger. The program entails web domains generating coins through mining, for the Monero crypto-currency and it uses the processing power of visitors computers to do so. Palo Alto Networks had found Coin-Hive on nearly 150 individual domains with the most popular locations being porn, video and file-sharing domains.

Diving headfirst into the Bitcoin arena may not be the smartest bet for the average investor, however. This is something that has been fueled by speculative trading and quick swings in either direction of a chart. There is stillvery little oversightright now even though the SEC has made strides to curb certain scams that arose from false initial coin offerings.

The company seems to be someone of an incubator of sorts for blockchain and cryptocurrency related projects. It was only in October the company changed its symbol (and name) to reflect the new direction. Previous to this, the company, known as Bioptix, was a maker of diagnostic machinery for the biotech industry.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Some are calling this one of the more pure plays when it comes to stock exposure to Bitcoin. According to the company, each share of stock is the equivalent to roughly 0.10 Bitcoin. The company allows its shareholders to gain near-direct exposure to Bitcoin without having to purchase Bitcoin directly, store it on or off of a server, or manage any safety protocols to prevent hacking.

Why Could Marathon Patent Group Benefit From Bitcoin?

A number of concerns have been raised regarding the cryptocurrency and ICO markets, including that, as they are currently operating, there is substantially less investor protection than in our traditional securities markets, with correspondingly greater opportunities for fraud and manipulation. Securities & Exchange Commission Chair, Jay ClaytonsStatementRegarding cryptocurrencies and ICOs.

Not only are shares nearly at a 1:1 price ratio to the price of Bitcoin but shareholders have been able to enjoy even more perks of investing as opposed to trading shares of the stock. For example, the company just announced that since it was able to liquidate a little over 172,000 Bitcoin Cash tokens, Record Date Shareholders on December 12, 2017, will receive $113.195042 per share, which is right around 3.5% of the current share price.

Assuming gross revenues from Bitcoin mining alone could produce a conservative $4 million per month at a price of roughly $12,500 per coin, MGT would be mining some 320 coins per month. If Bitcoin does reach those 6-figure projections, the revenue increase could be enormous for the company in 2018 and will most likely reflect positively on the price of the stock.

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

The value proposition here is not only the fact that investors can invest in something directly correlated to Bitcoin price movement, but they dont have to carry the same set of risks, have the same technology, and they can profit off of the trusts ability to benefit from things like forks and cryptocurrency liquidations. Until there is more competition, Bitcoin Investment Trust remains one of the only public companies to provide a more direct exposure to Bitcoin and as such, the rise in Bitcoin prices will offer much more value for shareholders as well as a bullish move for the companys stock as well.

The market for cryptocurrencies is not for everyone. But if you choose to get involved without opening up a digital wallet, several stocks and possibly many more to come, could offer the opportunity to benefit from the Bitcoin boom. Certainly, mining-based companies will be a quick way to find revenue-generating businesses that can grow the bottom line as Bitcoin prices follow suit.

Since the end of November, shares of Marathon have enjoyed a healthy upswing to highs of over $10 per share. Furthermore, the recent surge in many cryptocurrency stocks has begun to catch traction once again after the first round of Bitcoin futures went live on December 10.

Why Could Riot Blockchain Benefit From Bitcoin?

Average and even experienced investors do have options with several stocks, outside of the confusing waters of directly buying cryptocurrencies like Bitcoin.

With the obvious ecosystem being created right before our eyes, Riot has a hand in several financial systems that could prosper in the new norm of digital currency. As far as future potential for the company, Riot stands to benefit from a new endeavor into Bitcoin mining. It had announced this in early December. Similar to MGT Capital, Riots Bitcoin mining operations could generate significant revenues simply based on the price of Bitcoin making a move higher.

Editors Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

To this point, it was only last week that cryptocurrency mining platform NiceHash lost roughly 4,700 Bitcoins to hackers. While many investors are trying to grab hold of Bitcoin-related companies, they may also want to pay close attention to cyber security firms as well. With more companies making a play on cryptocurrencies, having to store them will become paramount and cyber security spending will likely increase as a result of changing landscapes for hackers to evolve from.

As the futures markets take aim at Bitcoin (for now), there could be new regulations already in the works. Digital currencies are outside the SECs oversight but the recent statement from Jay Clayton could be a sign that the Commission is ready to take on a more active role in regulating cryptocurrencies. Until then, its still more of the wild west when it comes to cryptocurrencies.

You do not have permissions for this room.

These are things like actually finding a safe place to open an account and then figure out a way to buy Bitcoin. But there are still stocks that trade on traditional exchanges that can offer investors exposure to the excitement of cryptocurrency companies.

In addition, investors may want to pay attention to ancillary, pick and shovel style companies that could offer power, hardware, software, and even real estate to house mining operations. Both Nvidia (NVDA) and Advanced Micro Devices (AMD), for example, have seen a boost to their stock prices after graphics cards have been used in high-end mining rigs to mine Bitcoin.

Why Could Bitcoin Investment Trust Benefit From Bitcoin?

To report a factual error in this article,

The reason being is that Marathon isnt just a digital currency company but a company that has a large pool of technology IP. This includes patents in digital imaging, biomedical, pharmaceutical, and telecom. For this reason, a play on Marathon could not only benefit from a boost in the cryptocurrency industry, but it could also protect investors from the pitfalls of such a volatile market, now and in the future.

Since the symbol change, the company has been further enhancing its currency holdings and strategic partnerships. This includes its goNumerical Ltd (dba Coinsquare) holding closing on over CAD $10 million at a valuation of over CAD $100 million. This particular strategic holding has an actual digital currency exchange in Canada.

Follow Small Cap Reporter and get email alerts

MGT Capital Investments has gained attention not only for its rising share price but also for its candid chief visionary John McAfee. The man has had some very interesting things to say about the price of Bitcoin. McAfee has been a pioneer in cyber security and now is taking his expertise to the world of blockchain.

Investors also need to be aware that outside of fraud, there have been many instances where cryptocurrency houses have become victims of large-scale hacking events. Even if investors are not taking part directly in Bitcoin, for example, public companies that do are still at risk.

The company also has holdings and partnerships with Tesspay, a blockchain-based escrow service for wholesale telecom carriers, and Verady, a cryptocurrency accounting and audit service. This month, the company entered into a non-binding letter of intent to merge with Cresval Capital Corp., a Canada-listed public company. Upon completion of this transaction, Riot would get some 41,600,000 shares of Cresval. At todays value, that is roughly $1.66 million in stock. With this merger expected to close during the second quarter of 2018, investors could have much more to look forward to next year.

Chat is not supported in your browser version.