Bitcoin has always had a lingering problem. In the recent wave of new upswings in prices, this issue has rarely been raised.

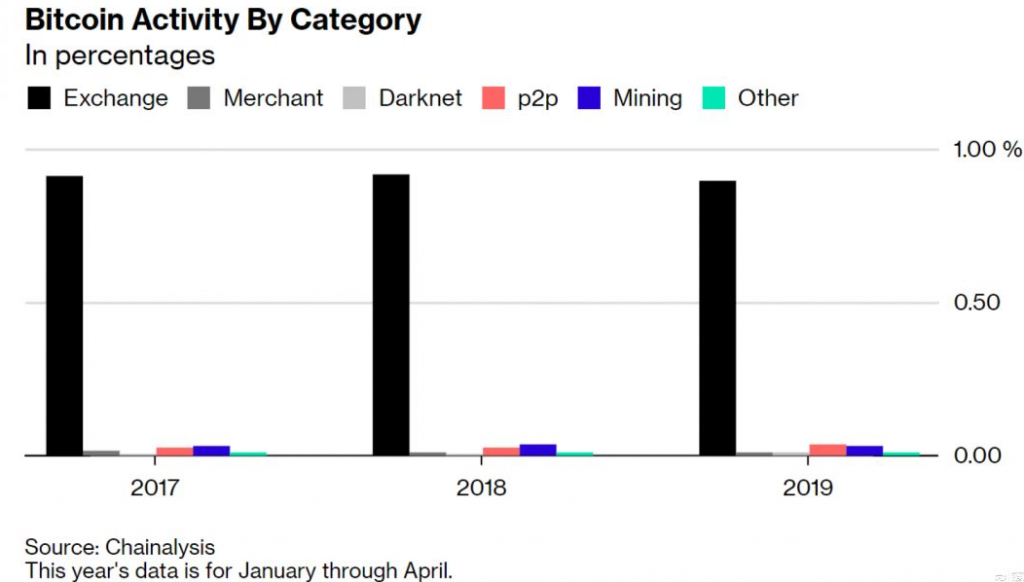

The problem is that almost no one uses the world’s largest cryptocurrency for anything other than speculation. According to data from the New York blockchain research firm Chainalysis, in the first four months of 2019, only 1.3% of economic transactions came from merchants, almost unchanged from the previous two years of prosperity and depression.

Although large companies like AT&T now allow customers to pay in cryptocurrencies, the problem is that when the price of digital assets may rise another 50% in a few weeks, few speculators are willing to pay for wireless services using digital currency.

This has become the main dilemma facing cryptocurrencies: on the one hand, Bitcoin needs to be hyped to attract the appeal of the public, and is considered to be a substitute for “money” electronic money; on the other hand, the market is also subject to the currency Influence, they advocate hoarding instead of daily consumption.

“Bitcoin’s economic activity continues to be dominated by foreign exchange trading,” Kim Grauer, senior economist at Chanalysis, said in an email. This shows that the main use of Bitcoin is still speculative, and Bitcoin has not become the mainstream of daily payments. ”

From 2017-2019, the amount of Bitcoin used for foreign exchange transactions far exceeds the sum of merchant transactions, dark net transactions, P2P, mining and others.

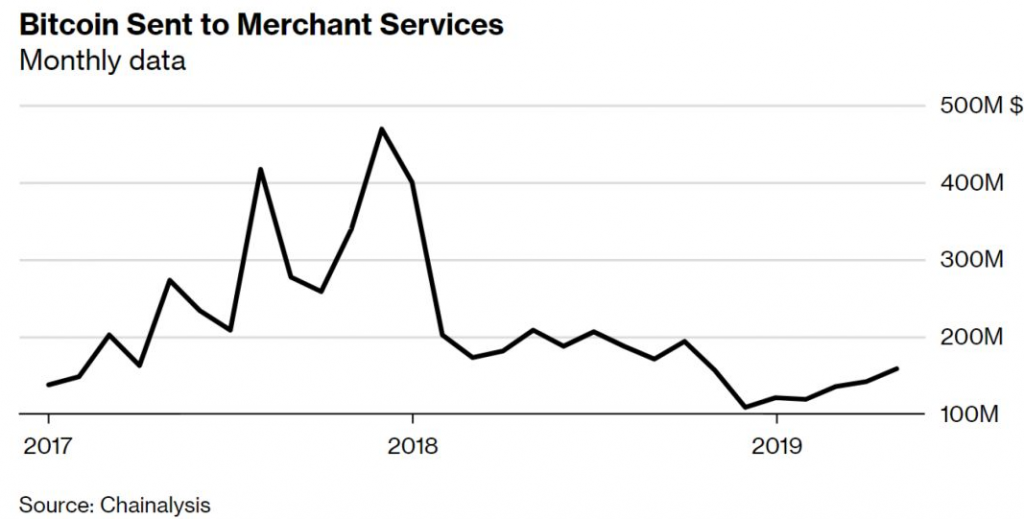

Chainalysis tracks Bitpay, which provides cryptocurrency payment processing services to merchants. Bitpay was recently selected as the payment service provider for AT&T, which handled $1 billion in both 2017 and 2018.

Bitpay works by: the customer pays in bitcoin, and the bitcoin represents the company to verify the funds and accept bitcoin. Businesses can choose to receive payments in three forms: Bitcoin, French or French plus Bitcoin. If the company chooses to accept 100% legal tender, the US dollar will be deposited into the bank account of the company on the next business day, minus 1% of the bitcoin cost of the entire process. This business is not affected by any bitcoin price fluctuations.

Bitcoin has more than doubled since January, approaching $9,000. In 2017, Bitcoin soared 1400% to nearly $20,000, and it fell more than 70% last year.

Sonny Singh, chief business officer at Bitpay, said: “From the trend observed last year, when bitcoin prices rise, American consumers will pay more in bitcoin. When the price of coins falls They will choose to sell bitcoin.”

Although Bitpay’s trading volume seems to be large, it is nothing compared to Visa. Last year, Visa handled nearly 5 billion transactions per day, and in 2018 it handled $11.2 trillion in payments and cash transactions.

Overall merchant service is still below the peak of the end of 2017, when the peak of the cryptocurrency bubble, merchant services accounted for 1.5% of the total activity of Bitcoin. According to Chainalysis, bitcoin prices plummeted before they began to pick up in 2019, and their usage at commercial outlets fell to 0.9% last year.

Chainalysis found that exchanges related to the exchange still accounted for 89.7% of Bitcoin transactions in the first four months of this year, only slightly lower than last year’s 91.9%.

This trend may be a negative sign of the long-term healthy development of Bitcoin. Its anonymous creator, Satoshi Nakamoto, envisions the use of bitcoin in everyday transactions, from buying coffee to paying for car rental. But recently, investors have been emphasizing that Bitcoin has been transformed into a digital version of gold – when the economy is uncertain, because bitcoin is not uncorrelated with stocks or bonds, such assets can be used as hedging and risk hedging assets.

Kyle Samani, co-founder of Multicin Capital, an American encryption hedge fund, is optimistic about Bitcoin and said in an e-mail: “I don’t expect Bitcoin to be used for any commercial activity now or in the short term, he added, value storage hypothesis is not It is too likely to be the ultimate optimal solution on a time scale of more than ten years.”

Chainalysis also found that while peer-to-peer bitcoin transactions also increased, black nets and illegal activities increased.

Efforts to support Bitcoin into daily commodity payments continue. Blockchain payment startup Flexa recently said it will allow people to use certain cryptocurrencies for payments at merchants such as Nordstrom and Whole Foods. Flexa has allowed people to use Bitcoin, Ethereum, BTC Cash and Gemini Dollar in more than 30,000 locations in the United States.

Jeff Dorman, chief investment officer of ARCA in Los Angeles, said in an e-mail: “Bitcoin is now the leader. Because of its biggest network effect and ‘brand’, Bitcoin may continue to be Leader, but I don’t think Bitcoin itself is ‘money’.” Bitcoin doesn’t have to be “money” to succeed. Many great techniques have also deviated from the original blueprint. ”