Five At Five: A Brighter Retail Forecast For 2018

© 2018 Whats Next Media and Analytics

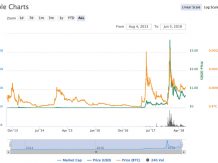

Headlines swirl around the price of bitcoin and its cryptocurrency cousins, around psychological barriers tied to $10,000 thresholds, around raids on suspect operators, around tax rates in South Korea and hacks of crypto exchanges.

Within the ledger technology the actual underpinnings of cryptocurrencies is where Holmes said theres potential. With a nod toRippleand the nascent partnership with MoneyGram, Holmes focused on two areas as a near-term roadmap for using alternative currencies and DLT to solve MoneyGrams real business problems.

Hedging Bets, Hedging Taxes As Taxman Cometh For Cryptos

May there be an opportunity to play on existing and regulated rails? Said Holmes: Central banks today are inefficient when it comes to international interactions. But even as Ripple may offer an alternative to banks, where those customers simply install APIs and work with them, if there are dozens upon dozens of competing services out there, as Holmes maintained, banks must decide which system they want to use. One very plausible outcome is that they may simply opt to use what exists today,SWIFT, which has become the global standard.

CFPB Settles With Payday Lender Over Scam Fees

Rather than MoneyGram putting millions in cash into a country and then exposing that cash to price volatility, Holmes said, they would be able to exchange money in real time and on the fly.

alex holmesBlockchaincross-bordercryptocurrencydistributed ledgerMain FeatureMoneyGramNewsRippleXRP

That said, Holmes also recognized that the technology is in its infancy and could just as easily be displaced by something we havent seen yet. Its why, he said, its important to be playing in this area, continually searching for optionality and identifying ways to streamline what is core to MoneyGrams business.

Our business is dynamic and changing quickly, and so, things like Ripple and partnerships with wallets around the world are going to be critical to our success, Holmes said, adding that youll see a lot of interesting announcements from us in the coming months.

Banks, Merchants Turn To Behavioral Biometrics To Fight Fraud

MoneyGram, the money remittance giant, has its sights set on a new strategic front that looks to leverage bits and bytes beyond the hype that clouds cryptocurrencies and the rails over which they travel. To that end, MoneyGram andRippleare joining forces to pilot a real-time settlement system and protocol that incorporating XRP, Ripples digital currency, into MoneyGrams payment flows. The pilot is being done through xRapid, the companies said in apress relea搜索引擎优化n Jan. 11.

PE Firms Increase Their Business Lending Prowess

Ripples xRapid is a foreign exchange investment vehicle that allows companies to take their U.S. dollars, convert them to XRP and, within seconds, convert them to another fiat currency.

MoneyGram CEO Alex Holmestold Karen Webster that amid optimism in a future in which new ways of moving money cross-border in real-time are beginning to emerge, a cautionary note must ring loud and clear. The excitement, Holmes told Webster, is alive and well and absolutely fascinating.

But, Holmes offered, throughAPIsand a tie-in with Ripple, its possible to move money between far-flung banks without the messaging and delays that stem from working within the traditional T+2 FX markets, which demand forecasting for local currency needs creating differences in price between time of trade and time of use. An instantaneous FX trading avenue using DLT and XRP, he noted, could help eliminate some of those time lag inefficiencies. Through the pilot, Holmes said they would examine whether the volatility of XRPs price has any impact on the cost of moving money across borders.

Are Big Changes Coming To The Military Lending Act?

Similarly, he said, Ripples xVia product has the potential to disrupt existing cross-border messaging systems.

A Single Scan And Done The Benefits Of Mobile Wallet Integration

Investors Have Lost Close To $100M In ICO Scams

As promising as all this may sound, Holmes acknowledged theres still a big gap between what exists today and what is needed to move money globally, at scale. He said his biggest concerns for alternatives to what exists today include regulation and central bank reactions to options that rely on distributed ledger technology and cryptocurrencies, in addition to having a network robust enough to operate at scale.

Holmes likened the emergence of bitcoin and others to mining from days of old really old, as in the Gold Rush. In lieu of pickaxe and shovel, you dig (or, in the age of cryptocurrencies, mine via server farm), find something and suddenly you are worth a [lot] of money.

Canadas Twist On The Digital Banking Model

Beyond the excitement and excitability of the trading lie, perhaps, are real-world business use cases, based largely on thedistributed ledgertechnology across which transactions are recorded.

Tesla, Slack Show Lure Of Non-Public Funding Amid High Mkt Valuations

Are Paper Catalogs Really Having A Moment?

But Holmes made it clear thats the speculative part of the crypto world and not where MoneyGram sees the value or value proposition.

TRENDING: Blockchain And Loyaltys $7B Problem

Use cases are emerging in cryptocurrencies and DLT, but separating the hype from the hope can be a challenge, both acknowledged. Its hard to wrap your head around the valuations and what is driving them, other than the expectation that at some point it will all get figured out and work, Webster said.

Currently, theres no real certainty as to how big or how much of a disrupter Ripple can become in regard to the status quo. However, blockchain andDLTare forcing people to think differently, said Holmes. Though blockchain might not be the answer to all the challenges inherent in moving money cross-border and having it available for MoneyGrams customers to access within seconds, the prospect of that technology makes coming up with solutions both interesting and likely to offer new perspectives across liquidity and data flow capabilities (on a 24/7, 365-day continuum), among other considerations.

Podcasts (Sign Up + Subscribe)Beyond The BuzzwordData Drivers

Its a model that, should it work, is absolutely compelling not just for cost savings, but also time savings, Holmes explained. Saving time and money is, of course, especially attractive to MoneyGram, as remittances flow across 120 currencies daily and globally.

The Coming Consolidation Of Marketplaces

Get our hottest stories delivered to your inbox.

The hardest thing to do is to movemoney across borders, Holmes acknowledged, and doing so requires more than just messaging technology. The actual money movement still demands bank authorization. Operating as a U.S. company across dozens of currencies requires constant revaluation and monitoring of balances tied to those currency holdings, settling them back to dollar and pound sterling and euro-denominated accounts, Holmes explained. In many cases, pre-funding accounts is necessary in some countries where banks are not open on the weekends.

DEEP DIVE: Digital Disbursements Solutions For Healthcare Payments

Signup for the m Newsletter to get updates on top stories and viral hits.

Little Evidence That Tether Has The US Dollar Reserves To Back Tokens

In Turkey (And Elsewhere) Devaluation Spurs Value Hunt Among Luxury Goods

Trackers / Reports / PlaybooksB2B API

Protests Mark Chinas Ruptured P2P Lending Landscape

Cross-Border Payments, Sans Friction