While Ripple may be overbought, that doesnt mean the market wont keep buying. In short, if XRP maintains its exponential growth during 2018, then its long-term fundamentals may change for the positive according to the Theory of Reflexivity a la George Soros.

Its no secret the crypto space is in a speculative frothy frenzy currently.

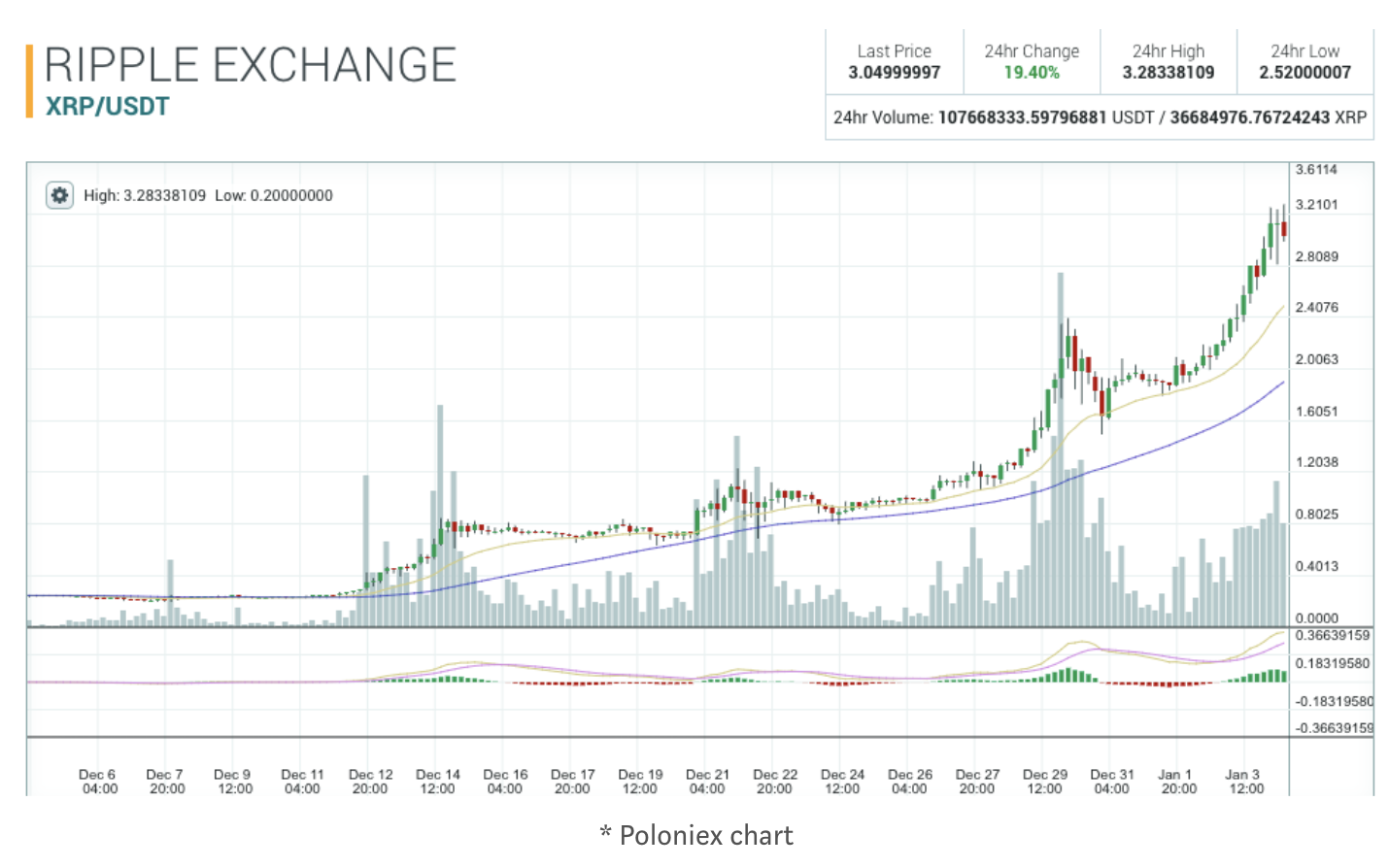

When we made a trading recommendation on XRP to our investor network last month, we stated that despite XRPs long-term hurdles, its price action and technical analysis charts were setting up nicely for a price spike.

Amidst this short-term frenzy, however, there is also opportunity for long-term analysis.

Subscribe to our free newsletter and follow us

Bitcoin Price Risks Further Drop After Close Below $6K

On-boarding financial institutions onto itsxCurrentandxRapidproducts in both exotic and non-exotic corridors.

Jan 6, 2018 at 20:15 UTC Updated Jan 8, 2018 at 13:39 UTC

At that time, XRP was trading between $0.25 $0.30.

The author invests in cryptocurrencies and has a position in XRP.

XRP is being driven primarily by speculation in our opinion.

Disclosure:CoinDesk is a subsidiary of Digital Currency Group, which has an ownership stake in Ripple.

How Does Blockchain Technology Work?

Under these circumstances, fundamental analysis becomes less important. Speculators are trading on emotion and greed, not fundamentals. Such is arguably the case with XRP, the native token that powers Ripples RippleNet ledger.

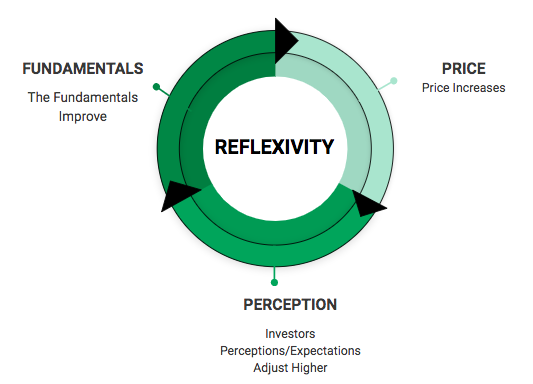

By simple definition, Reflexivity is a three-part process whereby an assets price increase drives investor expectations higher which positively changes the assets fundamentals, resulting in further price appreciation.

Institutional derivatives that would allow banks to hedge foreign exchange exposure on their balance sheet

This speculative demand spike would dramatically increase liquidity and potential derivatives coverage, which would help Ripple onboard more banks (fewer objections to adoption) onto xCurrent + xRapid, thus improving XRPs fundamentals, i.e. the path to QRC status.

Chris Brookins is the founder of Pugilist Ventures, a blockchain and fintech focused VC firm.

Looking ahead, Pugilist Ventures maintains both its speculative fundamental evaluation and its positive short-term trading view for XRP; simultaneously.

However, this speculation may actually increase the long-term probability of success for XRP by increasing market liquidity, derivatives coverage and mainstream adoption as medium of exchange and store of value; while planting the seeds of a future QRC debate.

The path to QRC status will need to include demonstrable growth within the following areas:

Over the last month, it has blown up by almost 1,400 percent, and its showing no signs of slowing.

The fundamentals in the case of XRP are basically its long-term probability of becoming a quasi-reserve currency (QRC) for financial institutions. (We say quasi because we do not believe central banks will ever fully relinquish their local currencies without a fight.)

Are you a CoinDesk user? Join our study and help us improve the website by clicking here.

Bitcoin Price Defends $6K as Traders Go Long

A $700 Million Cryptocurrency Called Ontology Is About to Go Live

What is a Decentralized Application?

Reflexive price appreciation may substantially increase demand and mainstream adoption for XRP. For example, imagine if XRP supersedes bitcoins (BTC) market cap in 2018.

Could XRPs Frenzied Rise Herald Future Growth?

We did not forecast a specific price target given we dont own a crystal ball, but we did see an interesting dichotomy forming. We thought Ripple had great company fundamentals and that XRPs speculative investment potential was ripe for high risk and high reward.

All of which provide fuel to Ripples most important business goal of growing financial institutions using both xCurrent and xRapid for global payments. Only time shall tell if this path bears fruit for Ripple and XRP.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by astrict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

I would like to receive the following emails:CoinDesk Weekly – Insights for the week aheadCoinDesk Daily – Our snapshot of the days news