Hot Money = Change in foreign exchange reserves Net exports Net foreign direct investment.

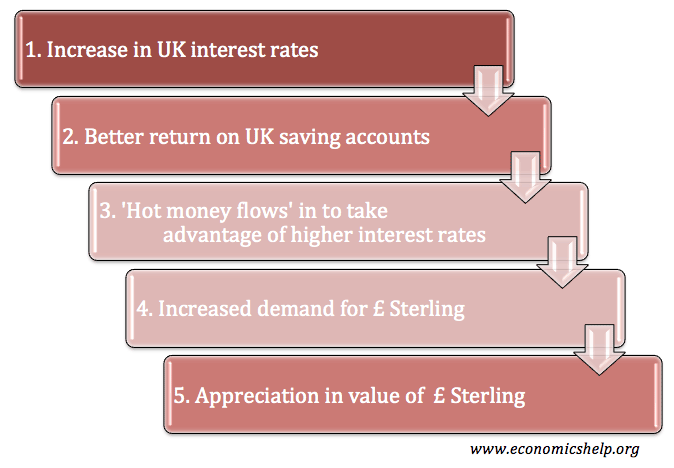

However, if the UK increased interest rates to 1.5% then you would get a substantially higher return from saving in a UK bank. Therefore, EU investors may sell Euros and buy Pound Sterling so that they can gain more interest from their savings.

In 2011, the Swiss Franc experienced a rapid rise as investors sought to buy Swiss Francs. Interest rates in Switzerland were not particularly high, but investors saw Switzerland as a safe haven from the Eurozone difficulties. Therefore, these hot money flows went from the Eurozone to Switzerland.

Carry trade, e.g. Euro carry trade this is when an investor borrows in a country with low-interest rates and invests in higher yielding economies.

Definition Hot money flows refer to capital flows moving to countries with higher interest rates and/or expected changes in exchange rates.

Impact of immigration on UK economy

This increased demand for Pound Sterling will push up the value of the Pound against the Euro.

Suppose the EU and UK both have an interest rate of 0.5%. At that time, it doesnt make much difference whether you put savings in the US banks or EU banks.

For international investors, there are substantial gains to be made from moving money between different countries with different interest rates.

Hot money flows can create excess liquidity fuelling a future asset boom and creating more long-term problems.

Tejvan studied PPE at LMH, Oxford University and works as an economics teacher and writer.Find out more

What are the effects of a rise in the inflation rate?

In other words, hot money is an inflow of foreign exchange reserves not related to actual exports or investment.

Hot money flows can be destabilising. A rapid rise in the currency can harm a countries exports because exports become more expensive.

Even small changes in interest rates can make a significant impact on exchange rates. Increased capital mobility means it is easier to transfer money across accounts. Money can be moved from one account to another with ease. Also, the commission from buying dollars will be quite limited making it more attractive to shift accounts.

It is hard to measure precisely because there is no clear definition of what exactly constitutes hot money.

You are welcome to ask any questions on Economics. I try and answer on this blog.Ask a question